How to create a budget and stick to it

Creating a budget and sticking to it can seem like a daunting task, but it doesn't have to be. In fact, it can be a fun and rewarding experience! Think of it as a game where the goal is to beat your own spending habits, and the prize is financial stability and peace of mind.

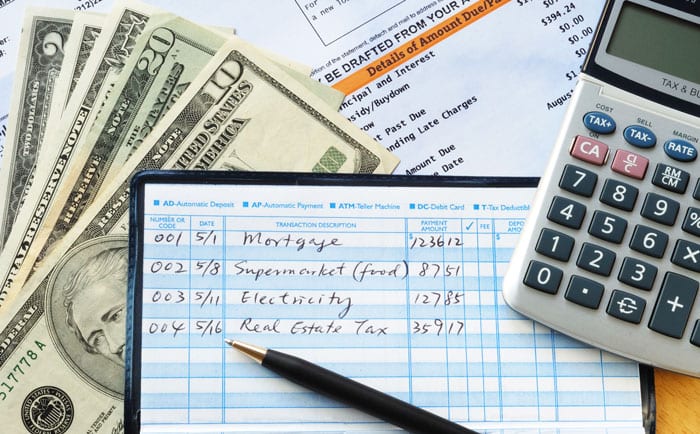

First things first, creating a budget is all about understanding where your money is going. This means identifying your income and expenses. It's important to be honest with yourself and not underestimate or overestimate any of it. Once you have a clear picture of your financial situation, you can start prioritizing your expenses. This means making sure your necessary expenses, such as rent and bills, are covered before less important expenses, like that extra latte or new pair of shoes.

Once you have your expenses in order, it's time to set some financial goals. This can be saving up for a down payment on a house, paying off credit card debt, or even taking that dream vacation. Having a clear financial goal in mind will make it easier to stick to your budget and resist the urge to overspend. And remember, the key to sticking to a budget is to track your spending and make adjustments as needed.

In the end, creating a budget is a process and it's important to be patient with yourself. It's ok to slip up and overspend every once in a while, the important thing is to not give up and to keep working towards financial stability and peace of mind. So, let's get to budgeting and make our money work for us!

Identifying your income and expenses

Identifying your income and expenses is the first step in creating a budget. It's important to be honest with yourself and not underestimate or overestimate any of it. This means gathering information on all your sources of income, such as your salary, bonuses, and any other sources of income. It also means identifying all your expenses, including your fixed expenses, such as rent and bills, and your variable expenses, such as groceries and entertainment.

To make this process easier, you can use a budgeting app or spreadsheet to keep track of all your income and expenses. These tools will allow you to input all your information in one place and give you a clear picture of your financial situation. You can also use bank statements and credit card statements to gather information on your expenses.

It's also important to note that identifying your income and expenses is an ongoing process, as your income and expenses may change over time. It's important to review and update your budget regularly to ensure that it remains accurate and relevant.

Once you have a clear picture of your financial situation, you can start prioritizing your expenses. This means making sure your necessary expenses, such as rent and bills, are covered before less important expenses, like that extra latte or new pair of shoes.

It's essential to be realistic and honest with yourself when identifying your income and expenses, as this will set the foundation for creating a realistic and achievable budget. Remember, a budget is a tool to help you manage your money and make the most of it. So, take the time to identify your income and expenses to ensure that you are on the right track to financial stability and peace of mind.

Prioritizing expenses

Once you have a clear picture of your income and expenses, it's time to start prioritizing your expenses. This means making sure your necessary expenses, such as rent, bills, and groceries, are covered before less important expenses, like eating out or shopping.

It's essential to make sure that your necessary expenses are taken care of first, as these are the expenses that you need to survive. These expenses should always be at the top of your budget list, and you should make sure to allocate enough money to cover them. This will help you avoid late fees, penalties and potential damage to your credit score.

After your necessary expenses are covered, you can start prioritizing your other expenses. This can be done by creating a list of all your expenses and ranking them in order of importance. For example, paying off credit card debt or saving for a down payment on a house may be more important than buying a new pair of shoes or going out for dinner.

It's also important to note that, as your financial situation and goals may change over time, so should your priority list of expenses. It's important to review and update your budget regularly to ensure that it remains accurate and relevant.

Another good way to prioritize expenses is by creating a budget for each category of expenses, such as housing, transportation, food, entertainment, and so on. This will help you to ensure that you are allocating the right amount of money to each category and make better decisions on where to cut back or allocate more funds if needed.

In summary, prioritizing your expenses is essential for creating a realistic and achievable budget. By making sure your necessary expenses are covered first and ranking your other expenses in order of importance, you can ensure that you are making the most of your money and working towards your financial goals.

Setting financial goals

Setting financial goals is an important step in creating a budget and sticking to it. It's a way to have a clear and specific target in mind, which will make it easier to resist the urge to overspend and make better decisions on how to allocate your money.

When setting financial goals, it's essential to make them SMART: Specific, Measurable, Attainable, Relevant, and Time-bound. This means, being clear on what you want to achieve, being able to measure your progress, making sure your goal is achievable, ensuring it aligns with your overall financial plans, and setting a deadline for achieving it.

For example, instead of saying "I want to save more money," you could say "I want to save $1000 for a down payment on a house by the end of the year." This goal is specific, measurable, attainable, relevant, and time-bound.

It's also important to set both short-term and long-term financial goals. Short-term goals can include things like paying off credit card debt, or saving for a vacation. Long-term goals can include things like buying a house, or saving for retirement.

It's important to note that as your financial situation and priorities may change over time, so should your financial goals. It's essential to review and update your goals regularly to ensure that they remain relevant and achievable.

In summary, setting financial goals is a key step in creating a budget and sticking to it. By making sure your goals are SMART and setting both short-term and long-term goals, you can ensure that you are making the most of your money and working towards financial stability and peace of mind. So, let's set some financial goals and make our money work

Creating a budget plan

Creating a budget plan is an essential step in managing your finances and sticking to your budget. The good news is that there are several methods to choose from, so you can find the one that works best for you.

One popular method is using a budgeting app. There are many budgeting apps available, some are free, others require a small fee. These apps can be a great tool as they allow you to input all your income and expenses in one place and give you a clear picture of your financial situation. Some apps also have features such as setting financial goals, tracking your spending, and providing reminders to stick to your budget.

Another popular method is using a spreadsheet. This can be a great option for those who prefer a more hands-on approach. You can create your own spreadsheet using a program like Excel or Google Sheets, or you can find templates online. A spreadsheet allows you to input all your income and expenses in one place and gives you a clear picture of your financial situation. You can also use it to set financial goals, track your spending, and make adjustments as needed.

A more traditional method is using pen and paper. This can be a great option for those who prefer a more tactile approach. You can create a budget notebook, where you can input all your income and expenses, set financial goals, track your spending, and make adjustments as needed.

No matter which method you choose, it's essential to review and update your budget plan regularly to ensure that it remains accurate and relevant.

In conclusion, creating a budget plan is an essential step in managing your finances and sticking to your budget. There are several methods to choose from, such as using a budgeting app, spreadsheet, or pen and paper. The key is to find the method that works best for you and be consistent in reviewing and updating your budget plan to ensure that it remains accurate and relevant.

Tracking your spending

Tracking your spending is a crucial step in sticking to your budget. It's not enough to simply create a budget, you also need to know if you are sticking to it. This is where tracking your spending comes in.

There are several ways to track your spending, such as using a budgeting app or spreadsheet, keeping a spending journal, or using a tracking tool such as a financial management app.

Using a budgeting app or spreadsheet is an easy way to track your spending. Many budgeting apps have features that allow you to input your expenses and track them against your budget. This way, you can see at a glance if you are sticking to your budget or if you need to make adjustments.

Keeping a spending journal is another great way to track your spending. This can be a simple notebook where you write down all your expenses as they occur. This way, you can see where your money is going and make adjustments as needed.

Another alternative is using a financial management app, these apps can connect to your bank account and credit cards, and automatically categorize and track your expenses for you. This way, you can see a real-time overview of where your money is going and make adjustments as needed.

No matter which method you choose, the key is to be consistent and track your spending regularly. This will help you to stay on top of your budget and make adjustments as needed.

In conclusion, tracking your spending is a crucial step in sticking to your budget. It's not enough to simply create a budget, you also need to know if you are sticking to it. There are several ways to track your spending, such as using a budgeting app or spreadsheet, keeping a spending journal, or using a financial management app. The key is to find the method that works best for you and be consistent in tracking your spending to ensure that you are sticking to your budget.

Adjusting your budget

Adjusting your budget is an essential step in managing your finances and sticking to your budget. Life is unpredictable, and it's important to be prepared for changes in income or expenses.

It's important to review and update your budget regularly, at least once a month, to ensure that it remains accurate and relevant. This means taking into account any changes in income or expenses. For example, if you have received a pay raise or a bonus, you can adjust your budget to reflect the increase in income. Similarly, if you have incurred unexpected expenses, such as car repairs or a medical emergency, you will need to adjust your budget to reflect the increase in expenses.

One way to adjust your budget is by cutting back on unnecessary expenses. This can include things like eating out, shopping, or entertainment expenses. By cutting back on these expenses, you can free up money to put towards your financial goals or to cover unexpected expenses.

Another way to adjust your budget is by increasing your income. This can be done by getting a part-time job, freelancing, or renting out a spare room. By increasing your income, you can put more money towards your financial goals or cover unexpected expenses.

It's also important to note that, as your financial situation and goals may change over time, so should your budget. For example, if you have paid off credit card debt or saved enough for a down payment on a house, you can adjust your budget to reflect these changes.

In conclusion, adjusting your budget is an essential step in managing your finances and sticking to your budget. It's important to review and update your budget regularly to ensure that it remains accurate and relevant. This can be done by cutting back on unnecessary expenses or increasing your income. It's also important to note that, as your financial situation and goals may change over time, so should your budget. This will help you to stay on top of your budget and make adjustments as needed.

Sticking to your budget

Sticking to your budget is the ultimate goal when creating a budget plan. However, it's not always easy to stick to it, as life is unpredictable and unexpected expenses can arise. But don't worry, there are several ways to stick to your budget and make the most of your money.

One way to stick to your budget is by setting reminders. This can be done by setting reminders on your phone or calendar, or by using a budgeting app that has reminder features. These reminders can be set to remind you to stick to your budget and make adjustments as needed.

Another way to stick to your budget is by being accountable. This can be done by sharing your budget with a friend or family member and asking them to hold you accountable. This way, you are less likely to overspend and more likely to stick to your budget.

It's also important to be flexible and make adjustments as needed. This means being open to changing your budget as your financial situation and goals change. For example, if you have paid off credit card debt or saved enough for a down payment on a house, you can adjust your budget to reflect these changes.

It's important to remember that sticking to a budget is a process and it's okay to slip up and overspend every once in a while. The important thing is to not give up and to keep working towards financial stability and peace of mind.

In conclusion, sticking to your budget is the ultimate goal when creating a budget plan. However, it's not always easy to stick to it, as life is unpredictable and unexpected expenses can arise. There are several ways to stick to your budget and make the most of your money, such as setting reminders, being accountable, being flexible and make adjustments as needed. Remember, sticking to a budget is a process and it's okay to slip up, the important thing is to not give up and to keep working towards financial stability and peace

Managing unexpected expenses

Managing unexpected expenses is an important part of sticking to your budget. Unfortunately, life is unpredictable and unexpected expenses can arise at any time. The key is to be prepared and have a plan in place to manage these unexpected expenses.

One way to manage unexpected expenses is by having an emergency fund. An emergency fund is a savings account that is set aside specifically for unexpected expenses. It's recommended to have at least 3 to 6 months of living expenses saved in an emergency fund. This way, when unexpected expenses arise, you have the funds to cover them without having to rely on credit cards or loans.

Another way to manage unexpected expenses is by being flexible with your budget. This means being open to making adjustments as needed. For example, if you have an unexpected expense, such as a car repair, you can adjust your budget to reflect the increase in expenses by cutting back on unnecessary expenses or finding ways to increase your income.

It's also important to be mindful of potential unexpected expenses and plan for them. For example, you can plan for car maintenance, home repairs, or medical expenses by allocating funds for them in your budget.

In conclusion, managing unexpected expenses is an important part of sticking to your budget. The key is to be prepared and have a plan in place. One way to manage unexpected expenses is by having an emergency fund, being flexible with your budget and being mindful of potential unexpected expenses and plan for them. By being prepared, you can make the most of your money and be ready for whatever unexpected expenses come your way.

Conclusion

In conclusion, creating a budget and sticking to it is an essential step in managing your finances and achieving financial stability and peace of mind. The process of creating a budget involves identifying your income and expenses, prioritizing expenses, setting financial goals, creating a budget plan, tracking your spending, adjusting your budget as needed and sticking to it.

It's important to remember that life is unpredictable and unexpected expenses can arise at any time. To manage these unexpected expenses, it's recommended to have an emergency fund, be flexible with your budget and be mindful of potential unexpected expenses and plan for them.

It's also important to review and update your budget regularly to ensure that it remains accurate and relevant. As your financial situation and goals may change over time, so should your budget.

By creating a budget and sticking to it, you can make the most of your money and work towards achieving your financial goals. Remember, budgeting isn't about being restrictive, it's about being smart with your money and making it work for you.

How to create a budget and stick to it

Reviewed by jadan

on

January 30, 2023

Rating:

Reviewed by jadan

on

January 30, 2023

Rating:

Reviewed by jadan

on

January 30, 2023

Rating:

Reviewed by jadan

on

January 30, 2023

Rating:

No comments: